Tax Credits for Start-up Retirement Plans

If you start a qualified retirement plan with auto-enrollment, your company may qualify to receive thousands in tax credits over a three-year period. A tax credit, different from a tax deduction, reduces the amount of taxes owed on a dollar-for-dollar basis. For example, when an organization in the 30% tax bracket receives a tax deduction of $1,000 it lowers its taxable income by $1,000, it saves $300 in taxes. If the organization received a tax credit, it could lower its taxes by $1,000.

Qualifications for eligibility:

- The company has 100 or fewer employees.

- The company has at least one plan participant who is not a highly compensated employee.

- In the three previous tax periods before the first year of eligibility, the employees did not receive contributions or accrued benefits in another plan sponsored by the company.

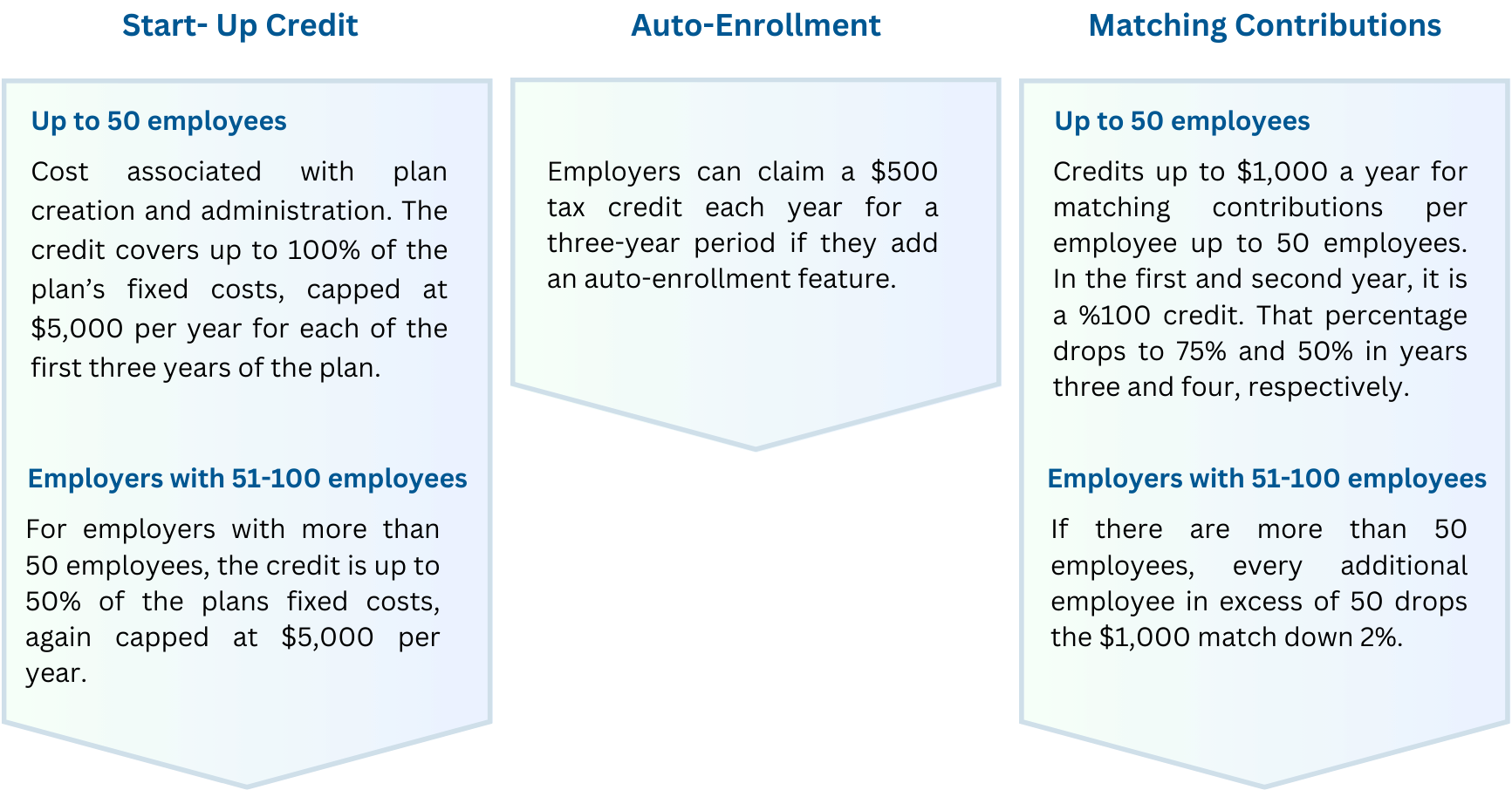

Three main credits that could benefit your company:

If you believe your company qualifies you may claim your credit by filling out this form FORM 8881. If you have any questions, please feel free to call us at 248-449-8300 or email rwelch@wwkinvestments.com

*Certain automatic enrollment and automatic escalation rules may apply.