A 529 qualified tuition plan (“529 plan”) is a tax advantaged investment vehicle designed for the use of a designated beneficiary’s education expenses. Contributions to 529 plan are after tax and earnings grow tax-free. Withdrawals are tax-free as long as the funds are used for qualified education expenses. While generally thought of as a college savings plan, there can be situations where trade school and pre-college education expenses would qualify.

A 529 qualified tuition plan (“529 plan”) is a tax advantaged investment vehicle designed for the use of a designated beneficiary’s education expenses. Contributions to 529 plan are after tax and earnings grow tax-free. Withdrawals are tax-free as long as the funds are used for qualified education expenses. While generally thought of as a college savings plan, there can be situations where trade school and pre-college education expenses would qualify.

What do you do if there is left over money in a 529 plan?

There is often uncertainty around unused 529 plan money. What if the beneficiary chooses not to attend college or receives a scholarship? The most popular option is to change the beneficiary to another member of the family. This could include siblings, but we’ve also seen clients move it to an eventual grandchild. The advantage is that the money continues growing tax-free for additional years and sometimes another decade or two.

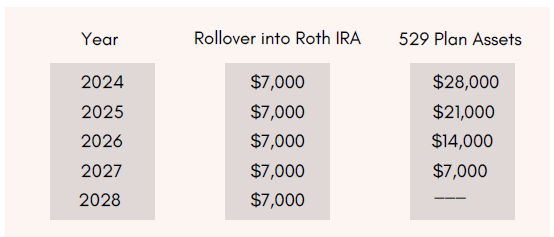

However, what if there is not another beneficiary or the owner simply does not want to transfer to another beneficiary? Fortunately, recent changes in legislation ease concerns surrounding left over funds. As of January 1, 2024, custodians are able to convert tax and penalty free 529 plan funds to a Roth IRA owned by the 529 beneficiary. The current IRS lifetime limit is $35,000 and contribution limits are still subject to annual Roth IRA contribution limits. Additionally, the 529 plan must have existed for at least 15 years prior to any Roth conversion.

Example:

To add some color to this investment strategy lets create a hypothetical example. John is a 23-year-old former Division I football player. His grandparents had set up a 529 account for him before they knew what a great athlete he was. Over the years total plan assets grew to $35,000, of which $15,000 are contributions and $20,000 are gains.

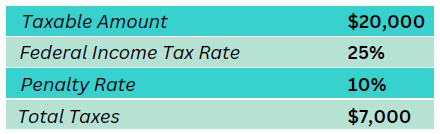

If John’s grandparents were to withdrawal the money there would be tax consequences of doing so. In addition, to paying federal income taxes they would owe a 10% tax penalty on the earnings portion of the funds, as the money won’ t be used for education expenses. See the table below for how John’s grandparents could be taxed.

What if John’s grandparents converted the assets into a Roth IRA?

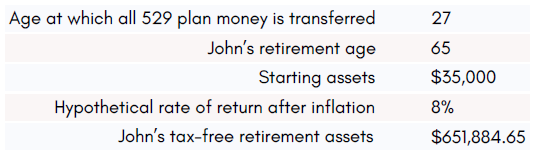

Now that the funds are John’s retirement account lets see the impact to his retirement savings.

*This hypothetical example assumes the annual Roth IRA contribution limit is $7,000 at the time of conversion and no further

contributions were made outside of the 529 rollover funds. This does not reflect real investment performance, fees, or inflation

nor does it account for investment growth or decline between 2024 and 2028. Returns will vary, and different investments will

provide better or worse performance.

Securities and advisory services offered through LPL Financial, a registered investment advisor, Member FINRA/SIPC