The Federal Reserve (Fed) raised interest rates 11 times since early 2022, the fastest rate hike cycle in decades. As a result, cash instruments such as money markets, CD’s, and saving accounts throughout 2023 became very attractive. While the Fed has no direct influence on savings rates, the yields tend to be highly correlated with changes to the federal funds rate. How will markets shift as we enter 2024?

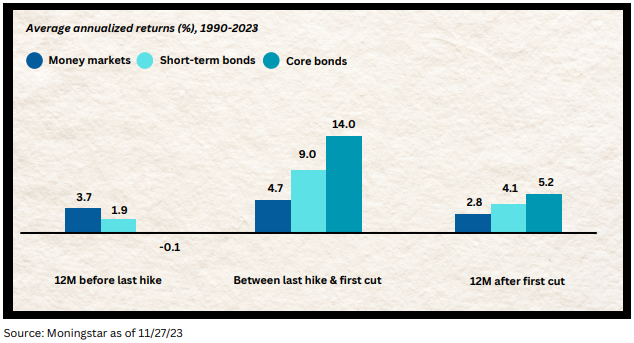

Cash investments are expected to become less attractive with the anticipated Fed rate cuts throughout 2024 and 2025. Not to fear, there is still opportunity in high quality, intermediate-term bonds. But when is the right time to make the switch? Historically there is a cost to being late when it comes to bond investing. Bonds tend to deliver their strongest performance during periods between the Fed’s last rate increase and first cut as shown in the chart below.

With bond yields at decade highs and bond prices trading at a discount there is an opportunity to take your cash off the sideline and put it to work in the bond market. If you recall from “Bonds 101” as interest rates rise, bond prices fall. A bond that offers bondholders a lower interest rate than current market interest rates is expected to be sold at a lower price than par value (remember a bond’s par value is $1,000). Why are higher yields and discounted prices an investment opportunity? Because bonds are math. If you hold a bond purchased at a discount to maturity, you receive interest payments over the life of the bond plus the difference between the discount price and par value at maturity.

Example: Interest rates rise after an investor purchases a bond. A bond is sold in the market with a 6% coupon at $900 with 5 years to maturity. If the investor holds the bond to maturity, they can expect $60 in interest per year (6%*$1,000) and a gain of $100 (the amount of the discount) at maturity.

As illustrated in the example, investors that purchase bonds at a discount enjoy regular interest payments along with capital gain potential. Why is this important now? As a consequence of the Fed increasing rates, high quality bonds are paying record high interest payments, along with capital gain potential at maturity. This opportunity comes with relatively low risk compared to equity markets.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Securities and advisory services offered through LPL Financial, a registered investment advisor, Member FINRA/SIPC.